GizmoLab Report: Cutting-Edge Developments in Web3 📈

The Gizmo Labs Newsletter brings you the latest insights and innovations in the Web3 space for all tech enthusiasts. Our goal is to be the go-to source for cutting-edge Web3 developments that readers eagerly anticipate everyday.

A Quick TL;DR:

- MakerDAO Rebrands to Sky, Launches SKY and USDS Tokens

- Polygon Miden Integrates QED to Accelerate Transactions

- Okto Wallet Secures UAE Operational License

- Celsius Pays $2.5B to Creditors in Bankruptcy

- SEC Charges Abra, Takes Kraken to Court

- Fantasy Top Rebounds with Record Trading Volume and Tactics V2 Launch

MakerDAO Rebrands to Sky Protocol, Introduces New Tokens SKY and USDS with Token Swap Options

MakerDAO, a major player in the decentralized finance (DeFi) space, has rebranded to Sky Protocol and introduced new tokens: SKY and USDS. The governance token MKR has been renamed SKY, and the stablecoin Dai (DAI) is now Sky Dollar (USDS). Current holders of MKR and DAI will have the option to swap their tokens for SKY and USDS. The conversion rate for MKR to SKY will be 1:24,000, while DAI will convert to USDS at a 1:1 ratio.

Sky Protocol will also support swapping Ethereum (ETH), USD Coin (USDC), and Tether (USDT) into the new stablecoin USDS. The new tokens are set to launch on September 18. Following the rebranding announcement, Maker's token price increased slightly, and trading volume surged by 139% to over $151 million.

Polygon Miden Boosts Transaction Speeds by 10x with QED Protocol Integration

Polygon Miden, a scaling solution for the Polygon network, has integrated the QED Protocol to enhance transaction execution speeds. This collaboration utilizes QED’s WebGPU API, enabling in-browser parallel computation, which is expected to accelerate client-side zero-knowledge (ZK) proof generation by up to 10 times. The integration aims to facilitate the creation of more complex decentralized applications (dApps) and real-world assets (RWAs) on the Miden network while reducing transaction fee variance.

Miden's modular execution layer and ZK rollup are designed to support high-throughput applications with robust privacy features. The Miden Virtual Machine (VM) focuses on STARK proofs, optimizing beyond the Ethereum Virtual Machine (EVM) capabilities. Polygon Miden is currently in its testnet phase, with plans to launch on the mainnet soon, further expanding Polygon's suite of scalability solutions. Meanwhile, Polygon's MATIC token has seen a 3.7% decline in the past 24 hours, with plans to migrate to the new POL token on September 4.

CoinDCX's Okto Wallet Becomes First Web3 Wallet to Obtain Operational License in UAE Free Zone

CoinDCX's self-custodial wallet, Okto, has secured an operational license from the Ras Al Khaimah Digital Assets Oasis (RAK DAO) in the United Arab Emirates (UAE). This makes Okto the first Web3 wallet to obtain such a license in the UAE’s dedicated economic free zone for digital assets. The license enables Okto to legally operate and provide its decentralized finance (DeFi) wallet services within the country. Okto is a multichain DeFi wallet managed by DCX Global, a Mauritius-based holding company. The platform provides a keyless, self-custody solution for managing digital assets, aiming to increase trust and accelerate Web3 adoption.

CoinDCX and Okto co-founder Neeraj. Khandelwal expressed optimism that the license would boost user confidence and enhance the growth of Web3 technologies among mainstream audiences.RAK DAO, established in 2023, is an economic free zone focused on virtual assets, blockchain, Web3, and AI, offering support for businesses in emerging technologies like the metaverse and NFTs. RAK DAO CEO Dr. Sameer Al Ansari highlighted that the licensing of Okto reflects the zone's commitment to fostering a transparent and supportive environment for innovative Web3 companies. This development follows CoinDCX's acquisition of UAE-based crypto exchange BitOasis and its continued efforts to expand its presence in the UAE.

Celsius Distributes $2.5 Billion to 251,000 Creditors Amid Bankruptcy Proceedings, Over 121,000 Creditors Yet to Claim Funds

Celsius, a bankrupt cryptocurrency lender, has distributed approximately $2.53 billion to 251,000 creditors, representing about 84% of the $3 billion owed to over 375,000 creditors as part of its bankruptcy proceedings. According to an August 26 court filing, this payout marks a significant step in the ongoing bankruptcy case that began in July 2022 when Celsius paused user withdrawals due to financial instability. Despite this progress, over 121,000 creditors have not yet claimed their funds. A large portion of these creditors are owed small amounts: around 64,000 creditors are due less than $100, and 41,000 are owed between $100 and $1,000.

The bankruptcy administrator has made several attempts to distribute funds, reporting over 2.7 million distribution attempts to the approximately 372,000 eligible creditors. Unclaimed funds are being redistributed via Coinbase every two weeks, with additional options to redeem through PayPal. Celsius' bankruptcy process follows a series of legal challenges, including settlements with the U.S. Federal Trade Commission, the Department of Justice, the Securities and Exchange Commission, and the Commodity Futures Trading Commission, totaling $4.7 billion in fines. Additionally, former CEO Alex Mashinsky was arrested on charges of.

SEC Charges Abra for Unregistered Securities, Prepares for Court Battle Against Kraken Over Alleged Unlicensed Securities Trades

The SEC has charged Plutus Lending LLC, the parent company of Abra, for operating as an unregistered investment company and offering unregistered securities through its Abra Earn program. The SEC alleges Abra sold nearly half a billion dollars of securities without proper registration. Abra, which stopped accepting new Earn customers in October 2022, agreed to a settlement pending court approval. Additionally, the SEC’s lawsuit against Kraken for alleged unlicensed securities trades is heading to trial.

The court ruled that the SEC plausibly argued Kraken facilitated securities investment contracts. Kraken’s legal officer highlighted that the court did not categorize individual cryptocurrencies as securities. The SEC has been increasing scrutiny on the crypto industry, focusing on unregistered securities. Under Gary Gensler’s leadership, the SEC claims most cryptocurrencies are unregistered securities. However, recent court rulings have challenged this assertion, stating that cryptocurrencies do not inherently comprise securities.

Fantasy Top Trading Card Game Surges with Highest Trading Volume Since June, Driven by New Tactics V2 Game Mode and Increased Player Engagement

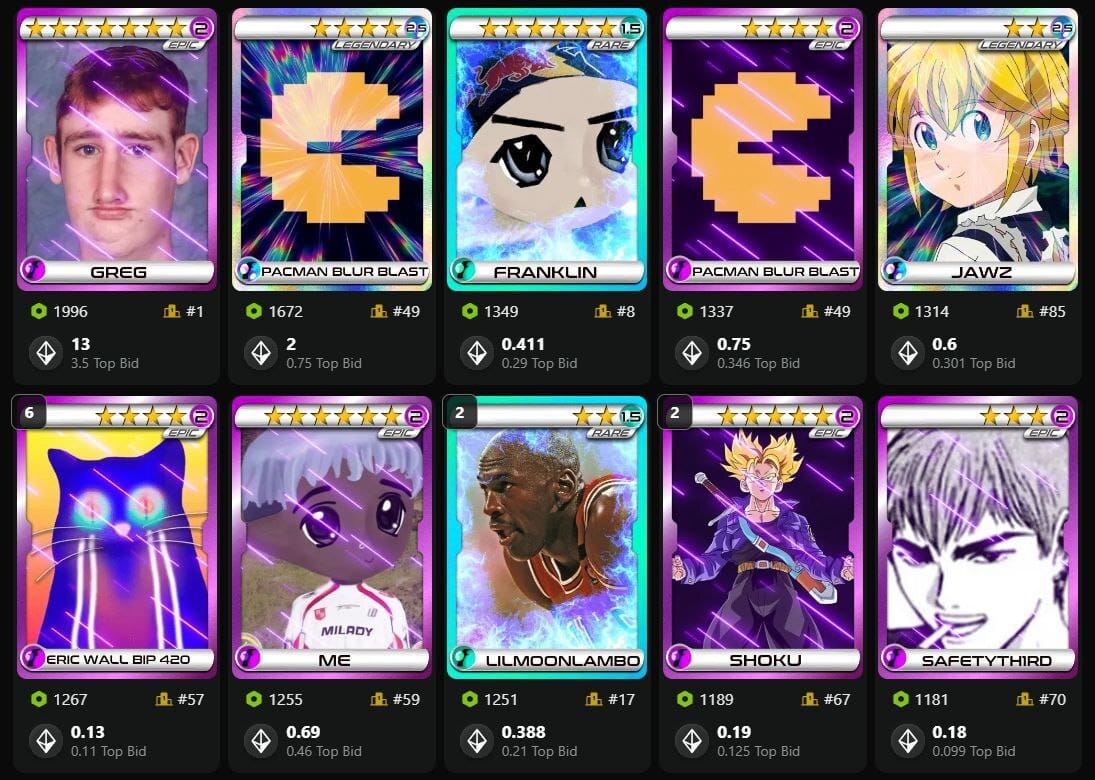

Fantasy Top, a SocialFi trading card game, is making a strong comeback, recording its highest trading volume since June on August 23, with 150 ETH. The platform saw a significant increase in weekly pack mints, reaching 1,825, compared to 450 the previous week. Fantasy Top allows users to speculate on social media performance of crypto-native Twitter personalities. The game has gained traction due to its Tactics competitions and rumors about the launch of its native token, FAN. Tactics V2, launched on August 2, introduced free entries, new payout structures, and a referral system, contributing to the platform's resurgence.

The new game mechanics focus on sustainability, pricing in fiat instead of ETH to stabilize user experience. The game initially faced volatility due to ETH-denominated pricing, which has now been addressed. On August 21, the platform achieved a record 21,580 entries in Tactics from 14,500 unique players. Founder Travis Bickle emphasized the platform’s focus on creating a sustainable ecosystem for long-term success. Following the initial hype from the Blast airdrop, card valuations and pack mint prices have stabilized. Bickle also noted the importance of maintaining a robust ecosystem after initial speculative bubbles have subsided.

Before you go, here’s a poll you might wanna participate in:

Don’t forget to hit the button that you see below!